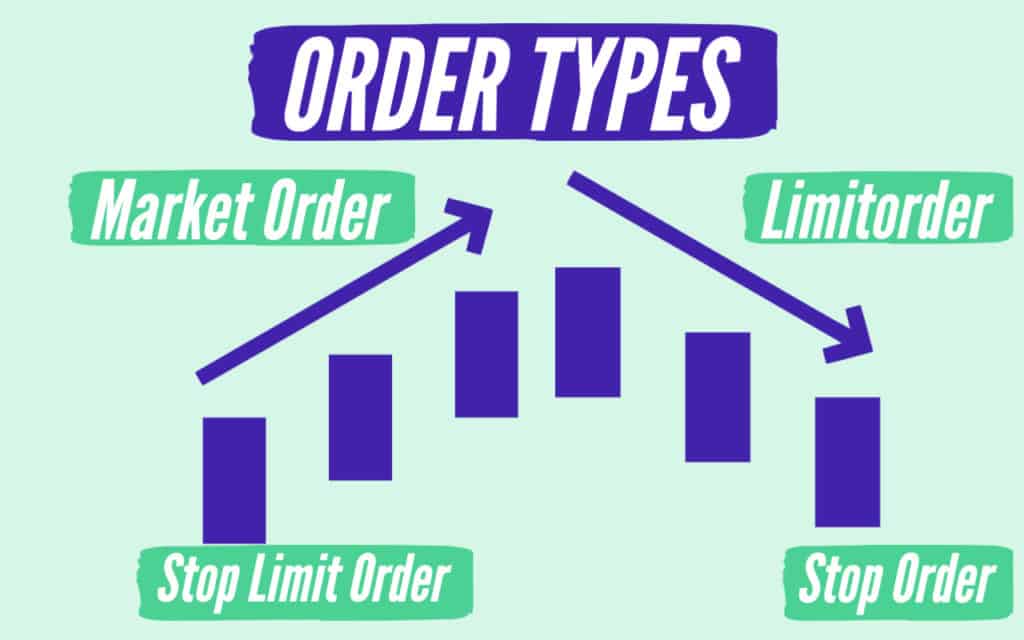

There are different stock order types (stock order types), each of which can lead to different results. Therefore, it is important to know the differences between them. Stock order types include the market order, limit order and stop order. Each order type can be considered as a separate tool that serves a specific purpose.

Therefore, before buying or selling a stock, it is worthwhile to identify the primary goal. Do you want to sell (execute) your stock (order) quickly at the current market price. Or is it more important for you to control the price of the trade. Once you know this, the appropriate stock order type can be chosen for your goal.

What is a market order? Stock Order Types

A market order is an investor’s request to buy or sell a stock at the best price currently available in the market. This stock order type is considered one of the fastest and most reliable methods to buy or sell a stock. For liquid stocks with a large market capitalization, the market order is usually executed immediately.

Since this order type should be executed as fast as possible, most of the popular brokers have a button (buy and sell button) for the market order. Therefore, when you click this button, you will enter the market order view and you can specify the stock you want to buy or sell. Usually, this type of order incurs the lowest costs, as the market order involves very little work for the brokers.

When should a market order be used?

Market orders are suitable for securities that are traded in very high volumes. Because here your order is usually executed very quickly and without any problems. The situation can be different for stocks with a low daily trading volume. Because here the bid-ask spreads – due to low trading – are usually large. Market orders for these stocks are therefore executed more slowly; sometimes also at unexpected prices (in the case of fast market movements).

What is a limit order? Order Types

A limit order is a type of stock order to buy or sell a stock that has a maximum or minimum price to be paid. The limit order is therefore executed only within the specified limit. If the price is within the limit when you place your order, but moves out of the limit before it is executed, you will not buy or sell. Instead, it will only be bought or sold when the price is again within your specified limit.

When should a limit order be used?

The limit order can be useful when you believe that you can buy at a lower price or sell at a higher price than the current price.

For example, if there is a stock whose price is currently at 100$, but you think that the price will fall to 90$ (in the near future) and this is the right time to buy, then you can use a limit order. You set the limit price to 90$. This way your order will be executed only when the price reaches 90$ or drops below it.

It works the other way around when selling. Your stock is worth 100$, but you think it will go up to 110$. Then you set a limit selling price of 110$. If the stock reaches or exceeds this value, it is sold. If it does not reach or exceed this price, it will not be sold.

The selling price of a limit order can be higher than the limit price. Vice versa, the purchase price of a limit order can also be lower than the limit price.

Sometimes the order may not be executed at all, even if the specified limit price is reached. This is due to the fact that there may be orders before your order that exclude the availability of stocks at the limit price.

What is a stop order? Stock Order Types

A stop order is a type of stock order that initiates the purchase or sale of a stock as soon as the price moves beyond a certain point. This increases the probability of reaching a predetermined entry or exit price. With this type of stock order you can limit your losses or hedge your profits. As soon as the predefined price is reached, the buy or sell is initiated and the stop order becomes a market order.

When is a stop order useful?

The stop order can be used, for example, as a so-called stop loss order. For example, if you have bought a stock for 100€ and the value has now risen to 150€, you can set up a stop sell order at 140€. If the price remains above this 140€, no sale will be initiated. If the price drops to 140€, the sale will be initiated automatically. This way you secure a part of your already achieved profit.

You should know that a stop order is entered into the order book only when the specified price is reached and is executed at the next available price. In case of strong market movements, the execution price may be significantly higher or lower than the specified stop order.

What is a Stop Limit Order? Stock Order Types

A stop limit order is a combination of a stop and limit order. Thus, when buying, the order is placed at the specified stop. This time it is placed as a limit order and not as a market order. As a result, the placed order will be executed at the maximum limit price. This way you can enter an uptrend and at the same time set the maximum buy price.

When selling a stock with a stop limit order, the order is also placed when the stop is reached and is also executed only at or above the limit. If the price falls below the specified limit, the order will not be sold.

With a stop limit order, however, you should be aware that in the event of strong market movements, you may not enter at all when buying and not exit at all when selling.

If you are still not sure whether you should start investing, then read our article on „Why buy stocks„. In our category „Stock Tips“ you will also find more useful information about trading stocks.

Conclusion

The different stock order types can help you buy or sell in the market as quickly as possible, limit losses, hedge profits and enter uptrends. Which stock order type you choose depends on your strategy.